You’ve done your homework, you know the many advantages of commodity futures as an investment…

- Diversification – commodities are supply and demand driven and are priced accordingly. A basket of 10 unrelated commodities provides more diversification than is possible with stocks.

- Raw goods – to be consumed or used as a store of value. They will always have value because there are no substitutes and the supply is limited.

- No Accounting Irregularities – Commodities are grown, raised and mined in diverse geographic regions. Much of the physical cash trades are contracted locally so there is no central accounting as with companies.

- Buy or Sell Short – It’s just as easy, and necessary, to go long or short a commodity. No borrowing of shares, uptick rules or spare of the moment limitations on short sales in times of crises (man made of course).

- Leverage – commodity exchanges allow speculators to put up a small deposit, called margin, to control a large investment. Prudent use of this leverage limits the amount of cash to be deposited in a brokerage account.

That last one, leverage, is probably the greatest attraction for many when it comes to commodity trading. The tremendous leverage offered by exchanges and the small opening balance needed with brokers makes it easy to get started.

But, be wary of the leverage offered by exchanges

Full use of exchange leverage will guarantee your failure as a commodity trader. Your chances of making it past the first month are near zero if your account is fully margined.

So why do exchanges offer so much leverage? It’s simple, low margins are not to benefit you, the speculator. Low margins are for the benefit of the Commercial interests (the producers and end-users of the commodities).

Commodity futures exchanges were created for commercials to hedge the risk of doing business. To transfer risk, commercials buy or sell the needed commodity contracts to match their physical supply or demand needs on the futures exchanges, in the form of forward contracts.

But they need someone to take the other side of the trade, to assume the risk. Someone like you, the speculator. To entice as many speculators as possible to play the game. the financial limitations have been greatly reduced by way of “margining” (example to follow).

Commercials need to put on huge positions to layoff the risk of doing business so there needs to be a lot of speculators making a lot of trades to create the liquidity necessary for the markets to work efficiently. Margin rules are the perfect way to get as many speculators as possible trading commodities. Just don’t fall prey to the leverage offered by the exchanges, never fully margin your account.

What full margining looks like

To trade a futures contract you only need 3% to 7% of the contract value in most market conditions, posted as margin. A contract of Corn controls 5,000 bushels which means the total market value of that contract is calculated by multiplying the market price by 5,000.

Today corn closed at $3.54 per bushel so the contract value as of this writing is ($3.54 x 5,000 = $17,700). But you don’t need the full $17,700 to trade corn on the Chicago mercantile futures exchange, in fact, you only need a small fraction of that amount, $935 or 5.28% of the contract value.

A trading account with $10,000 would be allowed to hold 10 corn contracts. The broker would post $9,350 in margin to the exchange and the account would now hold 10 contracts.

What is the expected daily change on 10 contracts of corn? In the last 30 days corn has averaged 3.5 cents per day. Each penny move is worth $50 per contract. $50 x 3.5 = $175 per contract. So $175 x 10 contracts = $1,750 daily expected change in value.

That equates to a whopping 17.5% change in account value on day one! A great return in one day assuming it goes the right way, but a huge loss if it goes the wrong way.

Clearly that kind of risk is just gambling. The chances of ruin are a certainty. So more thought needs to go into position sizing (the number of contracts to buy or sell for each market in your portfolio). The allowed risk by the exchanges just won’t work.

Position Sizing and Diversification

Diversification goes hand in hand with position sizing. To know how many contracts of each commodity to trade, you also need to know how many markets you will be trading.

And yes, you need to know before hand which markets you will trade. That way you can calculate the expected daily risk to your account. Not to mention, you need a defined plan that has been tested on historical data before risking money on live trades.

And, you need to give some thought to which markets, when combined in a portfolio, offer the best diversification. This is a key benefit to trading commodities. Being able to hold positions, both long and short, in markets that have nothing to do with one another.

Being fully margined in 10 markets is certainly going to be better than being fully margined in one, like the corn example before above. But not even diversification can save you from too much leverage. Only the combination of a well diversified portfolio and appropriate position sizing will work.

This is the key to success in this business so I’ll say it again – Diversification and appropriate position sizing are fundamental to profitability.

How much money is needed to trade commodities

To calculate an account size we have to make a few assumptions. Then we can back into the account size needed to appropriately trade a diverse portfolio of commodities.

Assumptions

- Diversification will require at least 10 markets

- Annual return needs to average at least 20%

- Maximum drawdown should stay below 30%

- Daily account value at risk – less than 20%

Ten markets are plenty to gain exposure to a wide range of sectors. We can never know in advance which markets or sectors will be profitable from year to year so the only thing we can do is maximize our exposure to capture profits when they come.

Trading takes a lot of time and energy so the returns must make it worthwhile. For this example we will set the minimum at 20%. Drawdown and return are inversely linked, as the return goes up (risk per trade increases) the drawdown goes down – more negative.

This relationship between return and drawdown is where the balancing act takes place. A happy medium needs to be found between an acceptable return and drawdown. This balance will be controlled by the percentage of total equity that is risked on each trade.

And the percent risk per trade will also define the average account value at risk from day to day. This means the risk per trade multiplied by the number of markets traded will need to be 20% percent or less to stay within the goal for the “Daily account value at risk”. Maximum risk per trade = 2% x 10 = 20%.

Putting it all together

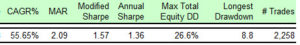

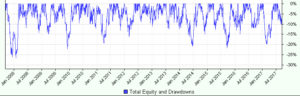

Using the guidelines outlined above and a sound trading system, the following inputs produced the desired outcome.

Risk per trade: 1.75%

Total markets: 10

History in test: 10 years

Starting balance: $500,000

These values achieve the objectives set forth, less than 30% drawdown, greater than 20% annual return and maximum daily risk less than 20%. We can now calculate the account size needed to trade this portfolio at $500,000.

However, a more realistic deposit in your brokerage account would be half that at $250,000 because of the margin rules. We wouldn’t really need that much in the account (no need to have cash sitting where it’s not used) but it would need to be accessible if needed. For example, if margins are raised down the road to a level that prevented the number of contracts needed to fulfil position sizing. Reaching max drawdown could also trigger the need for more cash.

But what if you don’t have $500,000?

There are several things you can do to reduce risk in order to trade a smaller account. The point I wanted to get across is that commodity futures contracts are big so a larger account is needed to conservatively trade a diverse set of markets. Here are a few things you can do to trade a much smaller account, all the way down to a couple thousand dollars…

- Trade a smaller portfolio

- Increase the risk per trade (this will also increase the max drawdown)

- Trade single market systems (this is almost a requirement when trading stock indexes)

- Trade Options, preferable option spreads

Back to the original question…

What should you trade, futures or options? It’s clear the first thing you should look at is your account size. Futures contracts are large and require more cash than required by margin rules alone to sufficiently back. To diversify across 10 markets or so is going to require well into 6 figures to conservatively trade. $250,000 of notional funding in the example I showed.

If you have anything less than that, all the way down to just a few thousand dollars, you should look to trade option spreads, single market systems or small portfolios. All of these have tradeoffs so a significant amount of study and research on your part is required before risking money in the markets.

As profits are accumulated or more deposits are made to your account you should always look to add more diversification before increasing trade size. In other words, starting with anything less than full diversification decreases your chance of success so always strive to reach full diversification.

I will be showing many more specific option spread trades, single market systems and alternate portfolios in the coming weeks, so stay tuned.